TDS Filling

TDS (Tax Deducted at Source) filing involves employers and deductors submitting details of tax deducted from income sources like salary, interest, or rent payments to the government, ensuring compliance with tax laws.

What is TDS? – TDS Meaning and Full Form

TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest etc. by the persons making such payments. Usually, the person receiving income is liable to pay income tax. But the government with the help of Tax Deducted at Source provisions makes sure that income tax is deducted in advance from the payments being made by you. The recipient of income receives the net amount (after reducing TDS). The recipient will add the gross amount to his income and the amount of TDS is adjusted against his final tax liability. The recipient takes credit for the amount already deducted and paid on his behalf. This will help the government to collect the taxes in advance and to track the transactions in an effective manner.

Example of TDS

Shine Pvt Ltd makes a payment for office rent of Rs 80,000 per month to the owner of the property. TDS is required to be deducted at 10%. Shine Pvt ltd must deduct TDS of Rs 8000 and pay the balance of Rs 72,000 to the owner of the property. Thus, the recipient of income i.e. the owner of the property in the above case receives the net amount of Rs 72,000 after deduction of tax at the source. He will add the gross amount i.e. Rs 80,000 to his income and can take credit of the amount already deducted i.e. Rs 8,000 by shine Pvt ltd against his final tax liability.

When Should TDS be Deducted and by Whom?

Any person making specified payments mentioned under the Income Tax Act is required to deduct TDS at the time of making such specified payment. But no TDS has to be deducted if the person making the payment is an individual or HUF whose sales from business or profession doesn’t exceed Rs.1 crore or Rs.50 lakhs, respectively.

However, in case of rent payments made by individuals and HUF exceeding Rs 50,000 per month, are required to deduct TDS @ 5% even if the individual or HUF is not liable for a tax audit. Also, such Individuals and HUF liable to deduct TDS @ 5% need not apply for TAN. Your employer deducts TDS at the income tax slab rates applicable. Banks deduct TDS @10%. Or they may deduct @ 20% if they do not have your PAN information.

For most payments rates of TDS are set in the income tax act and TDS is deducted by the payer basis of these specified rates. If you submit investment proofs (for claiming deductions) to your employer and your total taxable income is below the taxable limit – you do not have to pay any tax. And therefore no TDS should be deducted from your income.

Similarly, you can submit Form 15G and Form 15H to the bank if your total income is below the taxable limit so that they don’t deduct TDS on your interest income. In case you have not been able to submit proofs to your employer or if your employer or bank has already deducted TDS and your total income is below the taxable limit) – you can file a return and claim a refund of this TDS. The complete list of Specified Payments eligible for TDS deduction along with the rate of TDS.

What is the Due Date for Depositing the TDS to the Government?

The Tax Deducted at Source must be deposited to the government by the 7th of the subsequent month.

How to Deposit TDS?

How and When to file TDS returns?

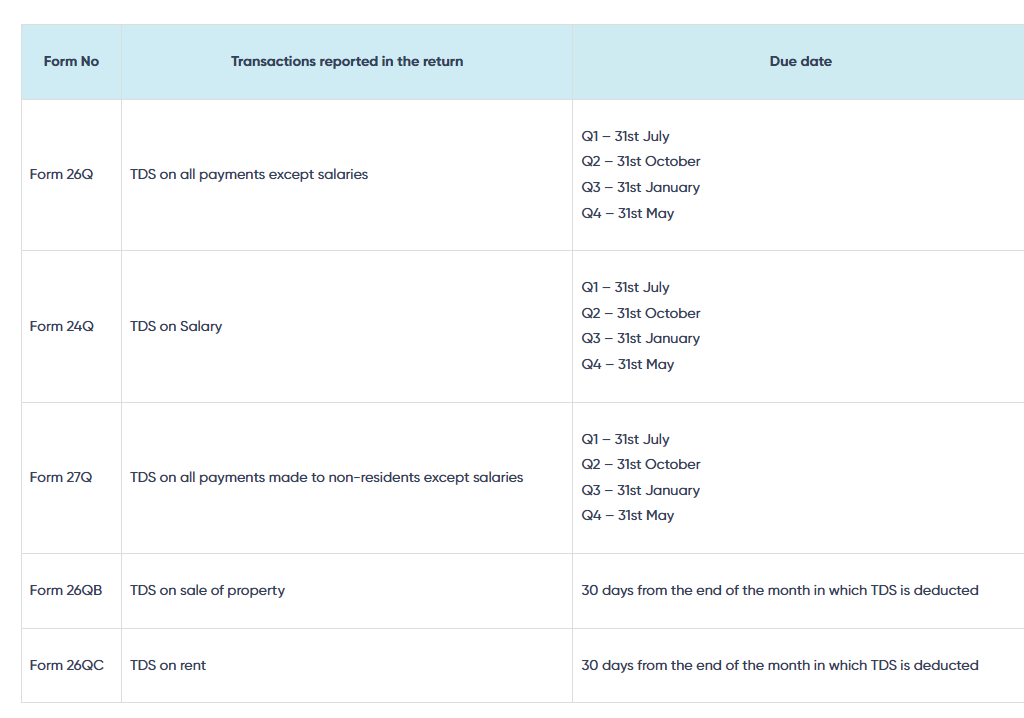

Filing Tax Deducted at Source returns is mandatory for all the persons who have deducted TDS. TDS return is to be submitted quarterly and various details need to be furnished like TAN, amount of TDS deducted, type of payment, PAN of deductee, etc. Also, different forms are prescribed for filing returns depending upon the purpose of the deduction of TDS. Various types of return forms are as follows:

What is a TDS Certificate?

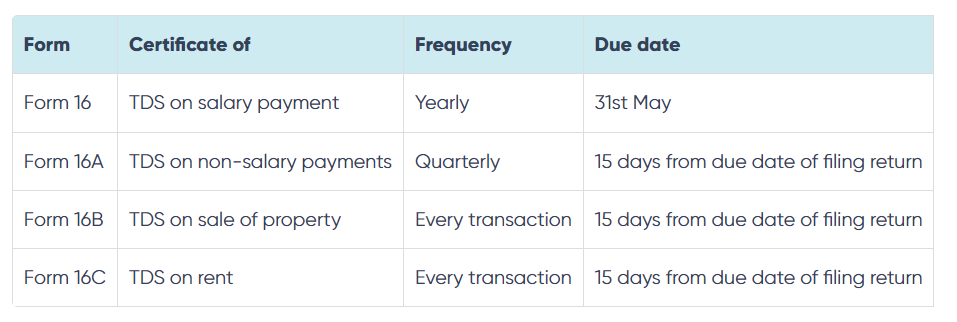

Form 16, Form 16A, Form 16B and Form 16C are all TDS certificates. TDS certificates have to be issued by a person deducting TDS to the assessee from whose income TDS was deducted while making payment. For instance, banks issue Form 16A to the depositor when TDS is deducted on interest from fixed deposits. Form 16 is issued by the employer to the employee.

TDS Credits in Form 26AS

It is important to understand how TDS is linked to your PAN. TDS deductions are linked to PAN numbers for both the deductor and deductee. If TDS has been deducted from any of your income you must go through the Tax Credit Form 26AS. This form is a consolidated tax statement that is available to all PAN holders.

Since all TDS is linked to your PAN, this form lists out the details of TDS deducted on your income by each deductor for all kinds of payments made to you – whether those are salaries or interest income – all TDS linked to your PAN is reported here. This form also has income tax directly paid by you – as advance tax or self-assessment tax (From FY 2022-23 it is made available in AIS). Therefore, it becomes important for you to mention your PAN correctly, wherever TDS may be applicable to your income.

An inaccurate claim of TDS credit can result in defective notice from the income tax department. Hence it is very important to reconcile the TDS credits in form 26AS with TDS receivables accounted in books, applicable mainly when TDS is made by multiple customers/vendors involved in business.

You can easily file your TDS returns through ClearTax software i.e. ClearTDS. It is an online TDS software that requires no download or desktop installation or software update. It helps you to prepare regular & correct e-TDS statements online easily with just a few clicks on your computer. It is also compatible with TDS returns of previous financial years for easy import. Also, you can generate your TDS certificates using ClearTDS.

How to Upload TDS statements

Follow the below guide for uploading TDS statements on the Income Tax Department website:

- Visit Income Tax website. Login with your TAN.

- Select e-File > Income Tax Forms > File Income Tax Forms on the dashboard

- Select the relevant form and fill in the details

- Validate the return using either DSC or EVC.

Types of TDS

- Salary

- Payments to Contractor

- Commission payments

- Sale of House

- Insurance Commission

- Interest on securities

- Interest other than interest on securities

- Rent Payment

- Professional fees

- Online Gaming

- Winning from games like a lottery, crossword puzzle, card, etc.

Frequently Asked Questions

A person who deducts TDS is responsible for the below:

- Obtain the Tax Deduction Account Number and mention it in all the documents pertaining to TDS.

- Deduct the TDS at the applicable rate.

- Deposit the TDS amount with the Government within the specified due date.

- File TDS returns within the specified due date.

- Issue the TDS certificate to the payee within the specified due date.

As per Section 206AA of the Income Tax Act, if you do not furnish your Permanent Account Number to the deductor, then the deductor shall deduct TDS at the higher of the rate prescribed in the relevant provisions of the Act or at 20%.

PAN is a Permanent Account Number and TAN stands for Tax Deduction Account Number.

TAN should be obtained by the person responsible to deduct TDS, i.e., the deductor. The deductor is required to quote TAN in all the documents relating to TDS.

However, there is an exception- in the case of TDS on the purchase of land and building under Section 194-IA, the deductor is not required to obtain TAN and can use PAN for remitting the TDS.

Also, in the case of TDS on rent as per Section 194-IB, and TDS on payment of certain sums by Individuals or HUFs as per Section 194M, the deductor can use PAN instead of TAN for remitting TDS.

The Finance Bill, 2021 introduced these provisions for deduction and collection of income tax at source at such higher rates if any sum is paid or payable to a specified person who did not file the IT return. Section 206AB is on TDS and inserted after section 206AA of the IT Act. It allows deduction of TDS at higher rates on those buyers who do not submit the Permanent Account Number (PAN). Likewise, Section 206CCA is on TCS and was inserted after section 206CC of the IT Act, with the same explanation as above. To know more, read our article on “Sections 206AB and 206CCA”.

There are several types of TDS defined by the law. To know more, read our article with a summarised table on various TDS types “TDS Rate Chart”.

Every employer must deduct TDS on salary at what is known as the ‘average rate of income tax’ of the employee for the year. It is denoted as Average Income tax rate = Income tax liability (arrived at based on slab rates) divided by the employee’s predictable income for the assessment year.