Financial Statements

Financial statements are formal records summarizing the financial activities and position of a business, including the income statement, balance sheet, and cash flow statement, used for external reporting and internal decision-making.

What Are Financial Statements?

Financial statements are written records that convey the financial activities of a company. Financial statements are often audited by government agencies and accountants to ensure accuracy and for tax, financing, or investing purposes. For-profit primary financial statements include the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Nonprofit entities use a similar but different set of financial statements.

Type of Statement

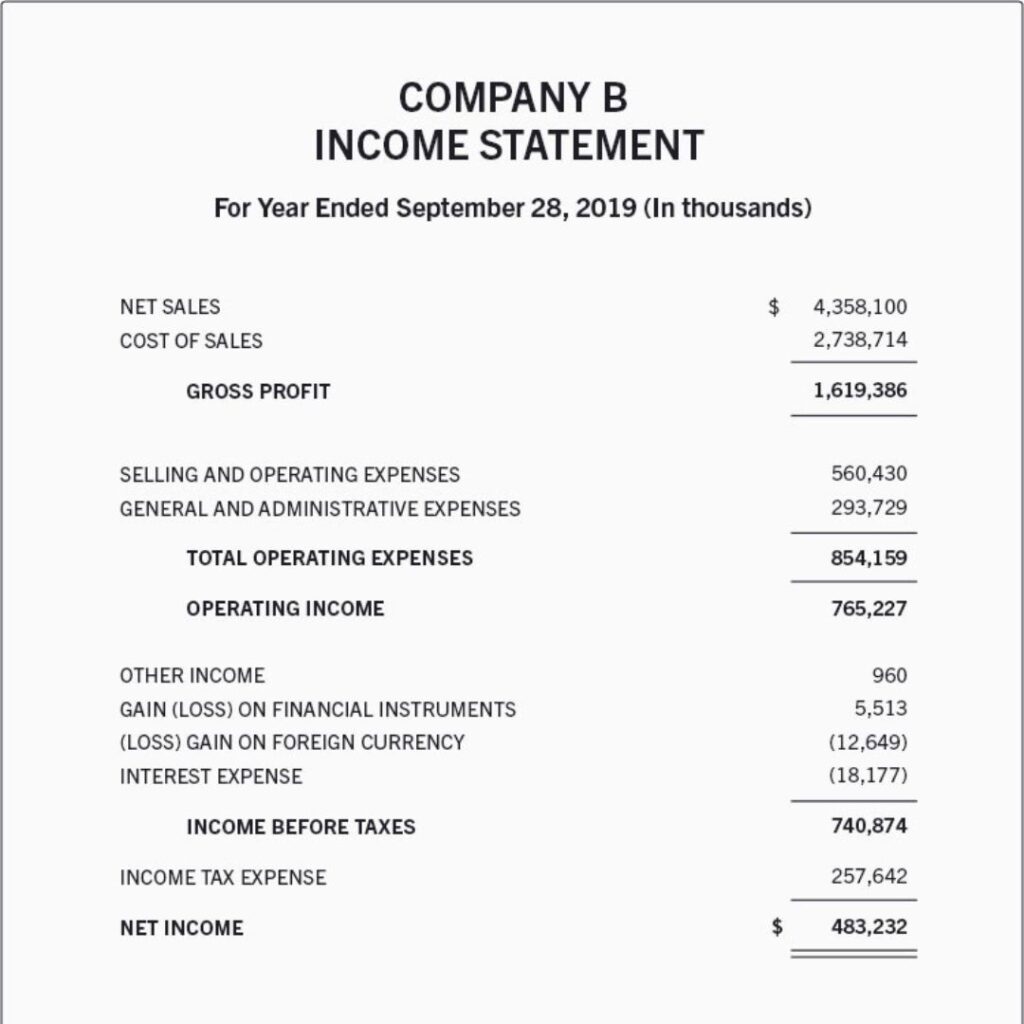

Income Statement

Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income statement provides an overview of revenues, expenses, net income, and earnings per share.

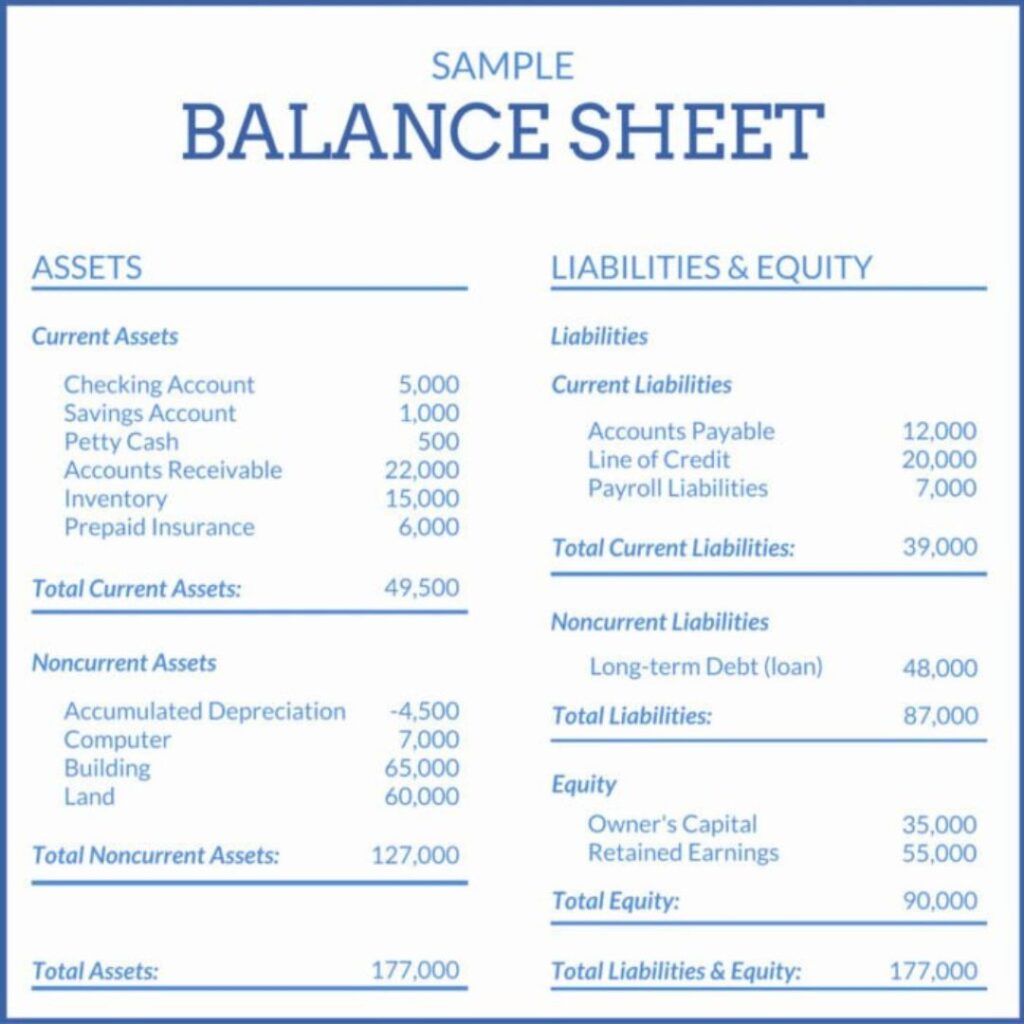

Balance Sheet

The balance sheet provides an overview of a company's assets, liabilities, and shareholders' equity at a specific time and date. The date at the top of the balance sheet tells you when this snapshot was taken; this is generally the end of its annual reporting period. Below is a breakdown of the items in a balance sheet.

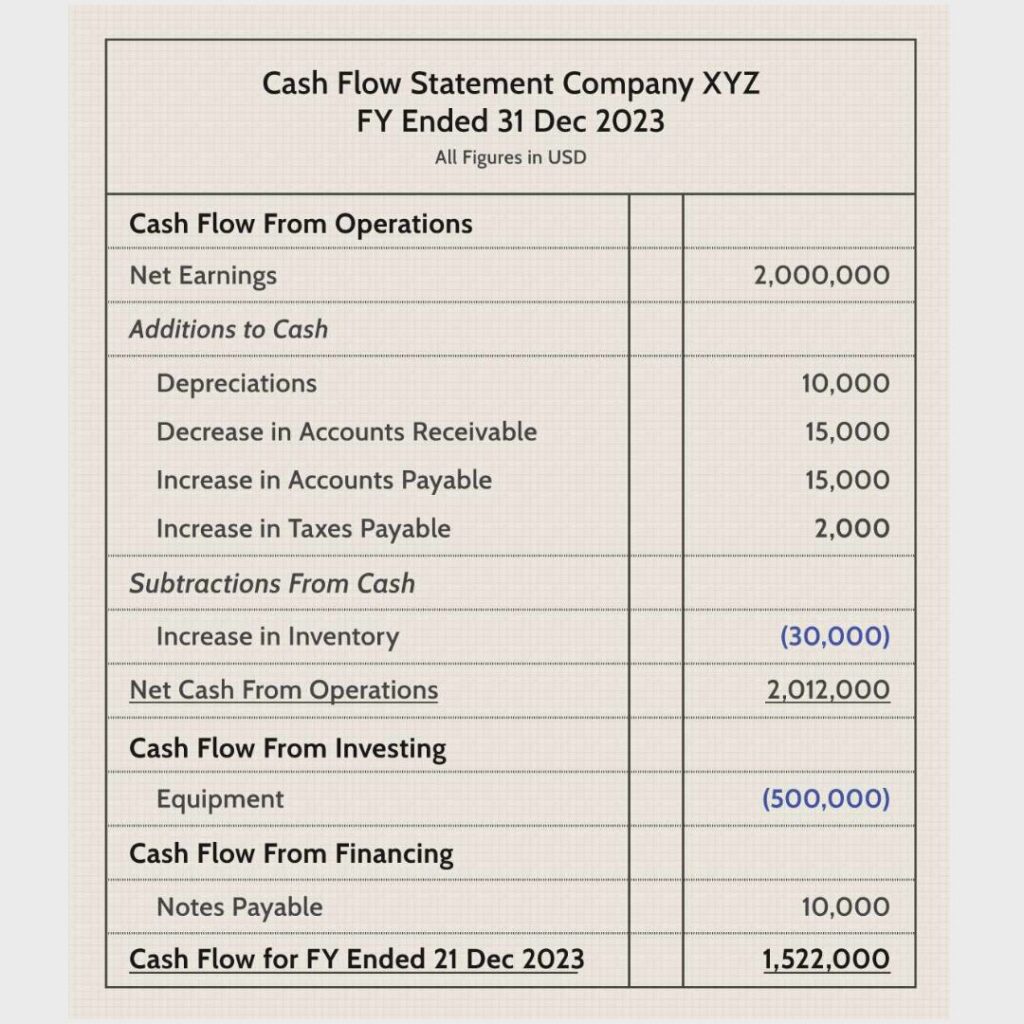

Cash Flow Statement

The cash flow statement (CFS) shows how cash flows throughout a company. The cash flow statement complements the balance sheet and income statement. The CFS allows investors to understand how a company's operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing.

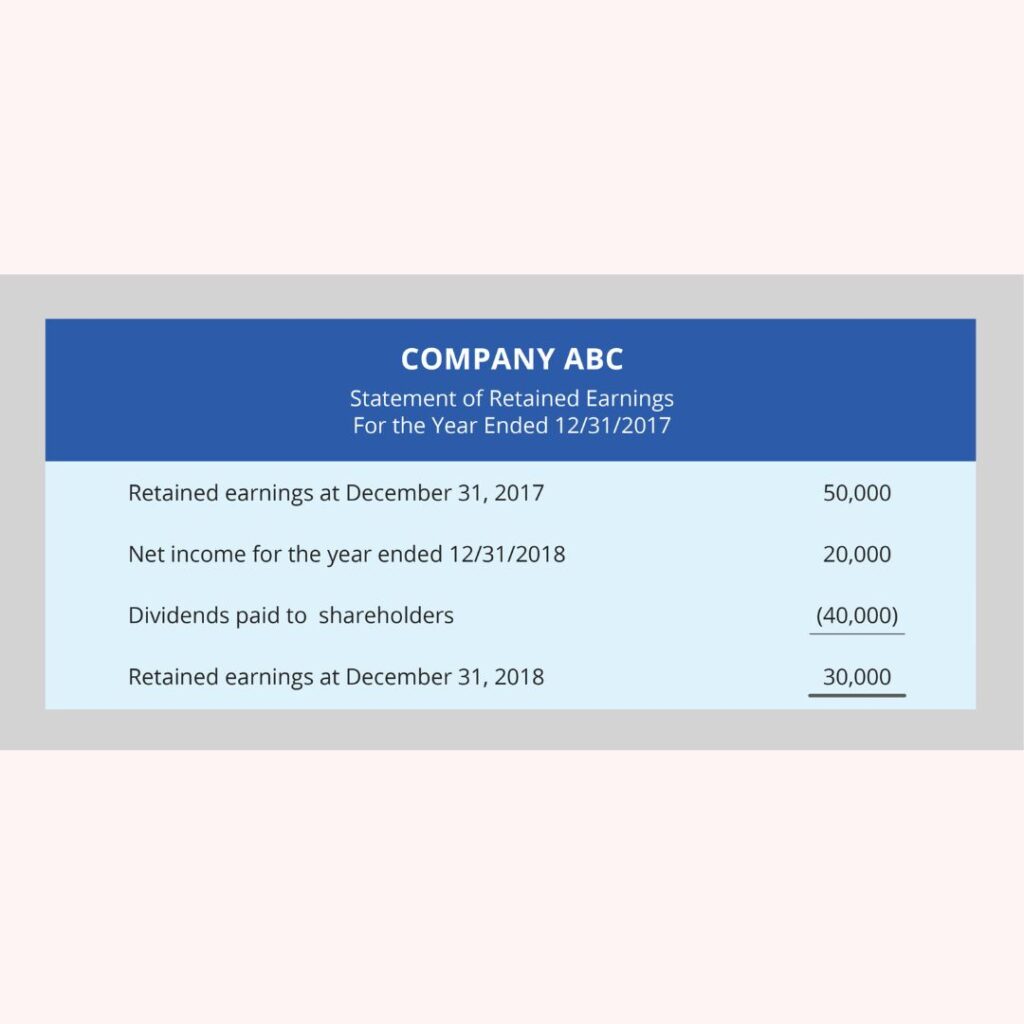

Statement of Changes in Shareholder Equity

The statement of changes in equity tracks total equity over time. This information ties back to a balance sheet for the same period; the ending balance on the change of equity statement equals the total equity reported on the balance sheet.

Who can require financial statements and reports on financial statements?

The requirement to provide financial documents in specific situations depends on who uses them and what their needs are. Financial statements and the associated reports may be required by:

- financing partners

- angel and private investors

- bonding and insurance companies

- regulatory agencies and tax authorities

- rating agencies

- suppliers

- unions

- investment analysts

Reporting requirements may obligate a business to disclose both year-end financial statements and interim (monthly, quarterly or semi-annual) documents, such as an interim balance sheet and income statement, aged receivables and payables, and a margin report.

Example of All Statement

KEY TAKEAWAYS

- Financial statements provide interested parties with a company’s overall financial condition and profitability.

- Statements required by Generally Accepted Accounting Principles are the balance sheet, the income statement, and the statement of cash flows, but you’ll likely see more in reports.

- The balance sheet provides an overview of assets, liabilities, and shareholders’ equity as a snapshot in time.

- The income statement primarily focuses on a company’s revenues and expenses during a particular period. Once expenses are subtracted from revenues, the statement produces a company’s profit figure called net income.

- The cash flow statement (CFS) tracks how a company uses its cash to pay its debt obligations and fund its operating expenses and investments.

Understanding Financial Statements

Investors and financial analysts rely on financial data to analyze a company’s performance and make predictions about the future direction of its stock price. One of the most important resources of reliable and audited financial data is the annual report, which contains the firm’s financial statements.

The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.

Balance Sheet

Assets

- Cash and cash equivalents are liquid assets, which may include Treasury bills and certificates of deposit.

- Accounts receivable are the amount of money owed to the company by its customers for the sale of its products and services.

- Inventory is the goods a company has on hand, intended to be sold as a course of business. Inventory may include finished goods, work in progress that is not yet finished, or raw materials on hand that have yet to be worked.

- Prepaid expenses are costs paid in advance of when they are due. These expenses are recorded as an asset because their value has not yet been recognized; should the benefit not be recognized, the company would theoretically be due a refund.

- Property, plant, and equipment are capital assets owned by a company for its long-term benefit. This includes buildings used for manufacturing or heavy machinery used for processing raw materials.

- Investments are assets held for speculative future growth. These aren’t used in operations; they are simply held for capital appreciation

FAQs on Financial Statements

Financial statements are formal records of a company’s financial activities, including the balance sheet, income statement, and cash flow statement.

They provide critical information for stakeholders to assess the financial health, performance, and cash flow of a company, aiding in decision-making.

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time, reflecting its financial position.

The income statement summarizes revenue and expenses to show profit or loss over a period, while the cash flow statement shows cash inflows and outflows from operations, investing, and financing activities.

Investors, creditors, management, and regulatory agencies use financial statements to make informed decisions.

Typically, financial statements are prepared quarterly and annually, but some companies may also prepare them monthly.