Balance sheet

A balance sheet is a financial statement that summarizes a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It provides a snapshot of the company’s financial position, showing what it owns (assets), owes (liabilities), and the amount invested by shareholders (equity). This helps assess the company’s solvency and overall financial health.

What Is a Balance Sheet?

How Balance Sheets Work

Special Considerations

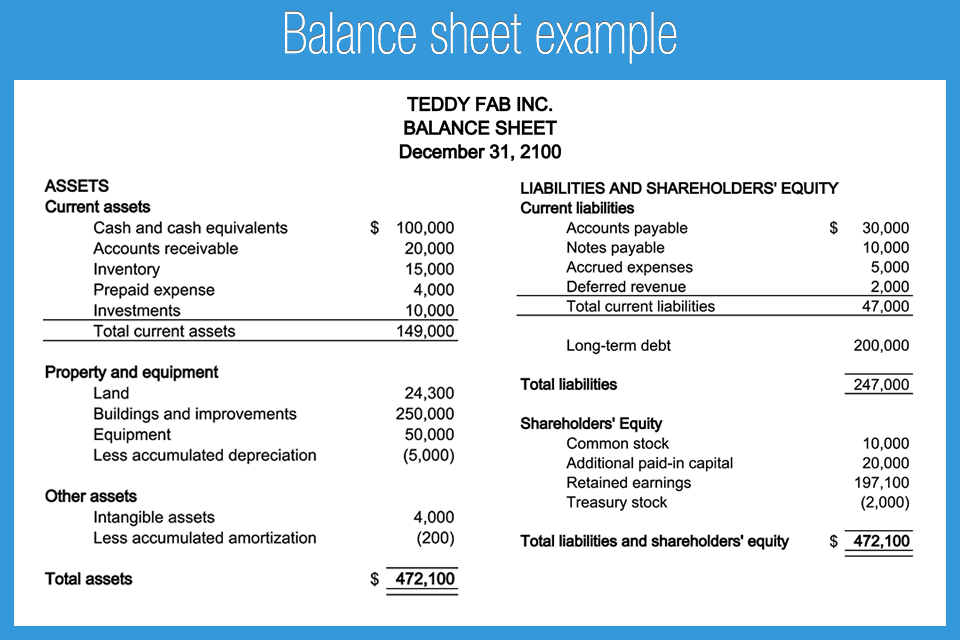

Components of a Balance Sheet

Assets

- Cash and cash equivalents are the most liquid assets and can include Treasury bills and short-term certificates of deposit, as well as hard currency.

- Marketable securities are equity and debt securities for which there is a liquid market.

- Accounts receivable (AR) refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe.

- Inventory refers to any goods available for sale, valued at the lower of the cost or market price.

- Prepaid expenses represent the value that has already been paid for, such as insurance, advertising contracts, or rent.

- Prepaid expenses represent the value that has already been paid for, such as insurance, advertising contracts, or rent.

- Fix assets include land, machinery, equipment, buildings, and other durable, generally capital-intensive assets.

- Intangible assets include non-physical (but still valuable) assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house. Their value may thus be wildly understated (by not including a globally recognized logo, for example) or just as wildly overstated.

Liabilities

Current liabilities accounts might include:

- Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability.

- Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes

- Wages payable is salaries, wages, and benefits to employees, often for the most recent pay period.

- Customer prepayments is money received by a customer before the service has been provided or product delivered. The company has an obligation to (a) provide that good or service or (b) return the customer’s money.

- Dividends payable is dividends that have been authorized for payment but have not yet been issued.

- Earned and unearned premiums is similar to prepayments in that a company has received money upfront, has not yet executed on their portion of an agreement, and must return unearned cash if they fail to execute.

- Accounts payable is often the most common current liability. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt.

Long-term liabilities can include:

- Long-term debt includes any interest and principal on bonds issued

- Pension fund liability refers to the money a company is required to pay into its employees’ retirement accounts

- Deferred tax liability is the amount of taxes that accrued but will not be paid for another year. Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

Shareholder Equity

Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends.

Treasury stock is the stock a company has repurchased. It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price.

Importance of a Balance Sheet

Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet.

First, balance sheets help to determine risk. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands.

Balance sheets are also used to secure capital. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts.

Managers can opt to use financial ratios to measure the liquidity, profitability, solvency, and cadence (turnover) of a company using financial ratios, and some financial ratios need numbers taken from the balance sheet. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company.

Last, balance sheets can lure and retain talent. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. For public companies that must disclose their balance sheet, this requirement gives employees a chance to review how much cash the company has on hand, whether the company is making smart decisions when managing debt, and whether they feel the company’s financial health is in line with what they expect from their employer.

Limitations of a Balance Sheet

Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. Because it is static, many financial ratios draw on data included in both the balance sheet and the more dynamic income statement and statement of cash flows to paint a fuller picture of what’s going on with a company’s business. For this reason, a balance alone may not paint the full picture of a company’s financial health.

A balance sheet is limited due its narrow scope of timing. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags.

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet.

Limitations of a Balance Sheet

The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior.

Why Is a Balance Sheet Important?

What Is Included in the Balance Sheet?

Who Prepares the Balance Sheet?

What Are the Uses of a Balance Sheet?

What Is the Balance Sheet Formula?

FAQs on Balance sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific date, showing its assets, liabilities, and shareholders’ equity.

Assets are resources owned by the company, including cash, inventory, equipment, buildings, and accounts receivable. They are categorized as current (short-term) or non-current (long-term) assets.

Liabilities are obligations or debts owed by the company, such as accounts payable, loans, bonds, and accrued expenses. Like assets, they are classified as current or non-current liabilities based on their due dates.

Shareholders’ equity, also known as net worth or book value, represents the amount of money that would be returned to shareholders if all assets were sold and all liabilities paid off. It includes common stock, retained earnings, and other comprehensive income.

A balance sheet shows the company’s financial position at a specific point in time, while an income statement (or profit and loss statement) reports the company’s financial performance over a period, showing revenues, expenses, and net income or loss.

It provides valuable information to investors, creditors, and analysts about the company’s financial health, liquidity, solvency, and ability to generate future cash flows. It is also used for decision-making, such as assessing creditworthiness and investment opportunities.

Balance sheets are typically prepared at the end of each accounting period, such as quarterly or annually. Publicly traded companies must publish balance sheets quarterly and annually for transparency and regulatory compliance.

Ratios like current ratio (current assets/current liabilities), debt-to-equity ratio (total liabilities/shareholders’ equity), and return on equity (net income/shareholders’ equity) are calculated using balance sheet data to analyze financial performance, liquidity, and leverage.