Net Worth Certificate/Valuation

A Net Worth Certificate or Valuation is a document assessing the financial value of assets and liabilities owned by an individual or entity, crucial for financial reporting, investments, and transactions.

What is a Net Worth Certificate?

A Net Worth Certificate is a financial document that summarizes an individual’s or entity’s financial position at a specific date. It lists all assets owned, including cash, investments, real estate, and other valuables, and deducts all liabilities such as loans, mortgages, and debts. This calculation provides a clear picture of the entity’s net worth, which represents the difference between assets and liabilities. Net worth certificates are commonly used in financial transactions, loan applications, legal proceedings, and business evaluations to assess financial health, creditworthiness, and overall economic stability of the entity or individual. They are often prepared by certified professionals using established accounting principles.

Why is a Net Worth Certificate Required?

The net worth certificate is a crucial document that can be required at multiple stages. Several financial institutions often require individuals or entities to submit a net worth certificate when applying for loans or credit facilities. Financial institutions like banks often need this document to understand the assets and liabilities of the concerned party.

This certificate is required to assess the applicant’s repayment capability, which is determined by subtracting the total liabilities from the total assets. Moreover, certain regulatory bodies may also require this certificate to verify the entity’s compliance with financial regulations.

Who Can Certify Net Worth?

Given that a net worth certificate is generally required for official and legal matters like loan applications, significant business deals, or regulatory compliance, this document must include verified financial data. For this reason, this document is certified by a Chartered Accountant, who adds credibility to the detailed financial data present in it.

Advantage of net worth certificate

Financial Assessment:

A net worth certificate offers a comprehensive evaluation of an individual's or entity's financial health, providing a clear picture of assets and liabilities.

Creditworthiness:

It helps lenders gauge the borrower's ability to repay loans by assessing their net worth and financial stability, influencing loan approval and terms.

Strategic Planning:

For businesses, it aids in strategic decision-making by identifying areas of financial strength and weakness, guiding investment and expansion strategies.

Legal and Compliance:

In legal contexts such as divorce proceedings or inheritance disputes, it serves as crucial evidence of financial status, supporting fair distribution of assets and liabilities among parties involved.

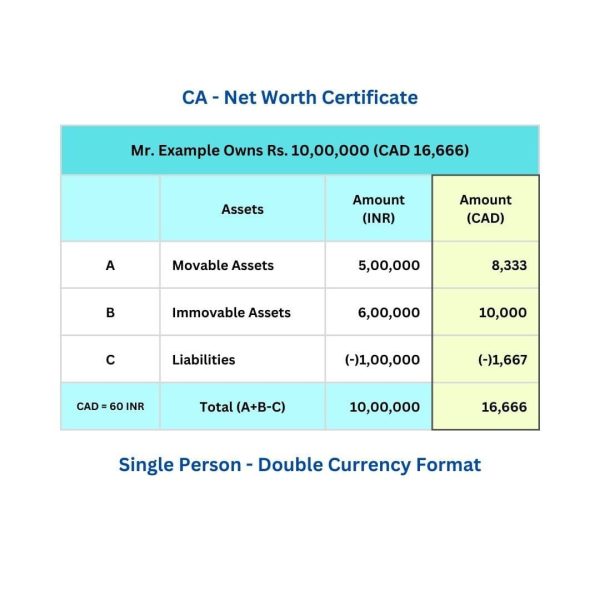

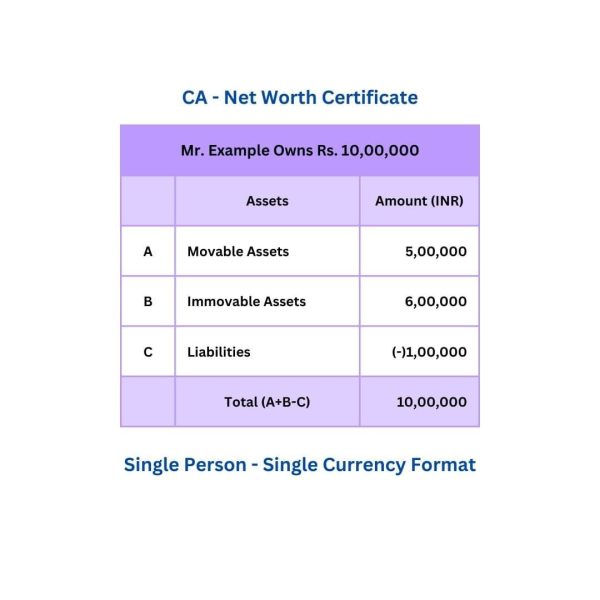

Net Worth Certificate Format

In India, net worth certificate generation is a streamlined process only CAs can execute. They must certify the financial documents and approve their validity. The certificate is simple, but the focus must be on getting the financial details right. The format of a standard net worth certificate is as follows:

Documents Required for Net Worth Certificate

You need to submit the following documents to obtain a net worth certificate:

- Personal Documents

- Proof of Identity (PAN card, Aadhar card, driving license, Voter ID card, or Passport)

- Proof of Address (Passbook, Income Tax Returns (ITR), electricity bill or property tax bill)

- Contact Information (Email ID and phone number)

- Financial Documents

- Income Statement – Outlining income and expenses incurred during a specified period, highlighting the overall financial performance

- Balance Sheet – Providing a comprehensive and accurate overview of assets and liabilities

- Bank Statement – Tracking all financial transactions, such as deposits and withdrawals over the last 12 months

- Property Documents – Including deeds, mortgage details, tax receipts or any other document related to any owned property, serving as an asset verification

- Investment Records – Highlighting the current worth of all investments such as mutual funds, stocks, bonds or any other investment securities

- Loan Documentation – Including loan agreement, payment records, and other relevant documentation that provides a comprehensive account of liabilities

- Tax Returns – Providing a comprehensive overview of income and tax obligation during a specified timeframe

Net Worth Certificate Charges

The charges applicable for preparing a net worth certificate vary, depending on factors such as the specific requirements of the certification process and the expertise of the CA. Getting your net worth certificate validated by a top CA expert in India could cost you more. However, all certified CAs are eligible to validate a net worth certificate.

Frequently Asked Questions

You can only get a net worth certificate from a qualified Chartered Accountant.

In India, only Chartered Accountants (CAs) have the authority and are eligible to make a net worth certificate for an individual or a business entity.

To obtain a net worth certificate, an individual or entity has to submit all financial documents, including income statement, balance sheet and so on. You also need to submit KYC documents such as ID proof and address proof.

The cost of obtaining a net worth certificate, be it for individuals or companies, varies from one CA to another.

A net worth certificate for tender is crucial to assess the financial viability of bidders participating to win the tender. This is usually required from businesses participating in government tender proceedings.

A net worth certificate is required for visa applications to verify whether the individual possesses the financial resources to support themselves during their stay in a foreign country.

Generally, a power of attorney is not necessary for a net worth certificate. However, if your situation demands it and the requesting entity needs to include a power of attorney, it can be done by CA professionals.