GST Invoicing

GST invoicing requires businesses to issue detailed invoices with GST rates, HSN/SAC codes, and transaction details. It ensures proper tax calculation and compliance with Goods and Services Tax regulations.

What is GST Invoicing

GST invoicing is a crucial aspect of the Goods and Services Tax (GST) system in India. It requires businesses to issue invoices that comply with specific guidelines to ensure proper tax calculation and reporting. A GST invoice must include essential details such as the seller’s and buyer’s GSTIN (GST Identification Number), invoice number, date of issue, description of goods or services, quantity, value, and applicable GST rates (CGST, SGST/UTGST, and IGST). Additionally, the Harmonized System of Nomenclature (HSN) code for goods or the Services Accounting Code (SAC) for services must be mentioned to classify the items accurately.

Benefits of GST Invoicing

Tax Compliance and Accuracy:

GST invoicing ensures that businesses comply with tax regulations, providing accurate details about the transaction, tax rates, and amounts. This helps in minimizing errors and discrepancies, ensuring that the correct amount of tax is collected and remitted.

Facilitates Input Tax Credit (ITC):

Proper GST invoices are essential for claiming input tax credit. Businesses can use these invoices to offset their GST liability, reducing the overall tax burden. This promotes transparency and efficiency in the tax system.

Reduces Fraud and Evasion:

GST invoicing helps in reducing tax evasion and fraud by creating a clear and traceable record of transactions. This makes it easier for tax authorities to monitor and verify the authenticity of transactions, ensuring that all parties are adhering to tax laws.

Streamlines Business Operations:

Standardized GST invoices streamline business operations by simplifying the billing process. It enables businesses to maintain consistent and organized records, which aids in auditing, accounting, and financial management, ultimately enhancing operational efficiency.

Who should issue GST Invoice?

If you are a GST registered business, you need to provide GST compliant invoices for sale of good and/or services.

Also, you should receive GST invoices from your vendors to claim the Input Tax credit (ITC).

What are the mandatory fields a GST Invoice should have?

- Invoice number

- Invoice date

- Customer name

- Shipping and billing address

- Customer and taxpayer’s GSTIN (if registered)**

- Place of supply

- HSN code/ SAC code

- Item details i.e. description, quantity (number), unit (meter, kg etc.)

- Total value

- Taxable value and discounts

- GST rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Signature of the supplier

- Name and address of the recipient

- Address of delivery

- State name and state code

What are other types of invoices?

a. Bill of supply

- Registered person is selling exempted goods/services,

- Registered person has opted for composition scheme

Invoice-cum-bill of supply

b. Aggregate invoice

If the value of multiple invoices is less than Rs. 200 and the buyer are unregistered, the seller can issue an aggregate or bulk invoice for the multiple invoices on a daily basis.

For example, you may have issued 3 invoices in a day of Rs.80, Rs.90 and Rs. 120. In such a case, you can issue a single invoice, totalling Rs.290, to be called an aggregate invoice.

c. Reverse charge invoice

A taxpayer liable to pay tax under Reverse Charge Mechanism (RCM) has to issue an invoice for goods or services or both received by him. The receiver shall mention the fact that the tax is paid under RCM. In addition, they have to issue a payment voucher while making payment to the supplier.

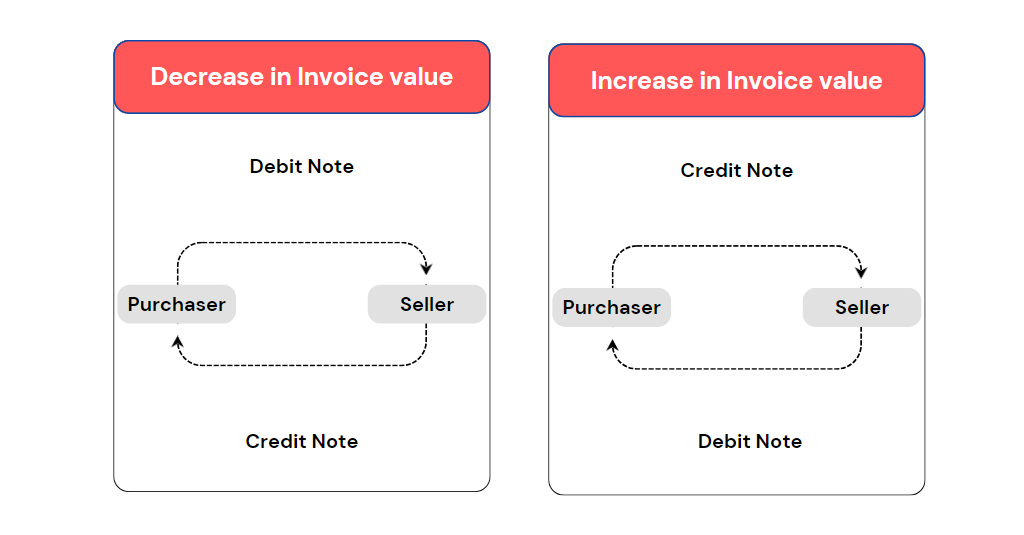

d. Debit and credit note

A debit note is issued by the seller when the amount payable by the buyer to seller increases:

- Tax invoice has a lower taxable value than the amount that should have been charged

- Tax invoice has a lower tax value than the amount that should have been charged

A credit note is issued by the seller when the value of invoice decreases:

- Tax invoice has a higher taxable value than the amount that should have been charged

- Tax invoice has a higher tax value than the amount that should have been charged

- Buyer refunds the goods to the supplier

- Services are found to be deficient

Can you revise invoices issued before GST?

Yes, you can revise invoices issued before GST. Under the GST regime, all the dealers must apply for provisional registration before getting the permanent registration certificate.

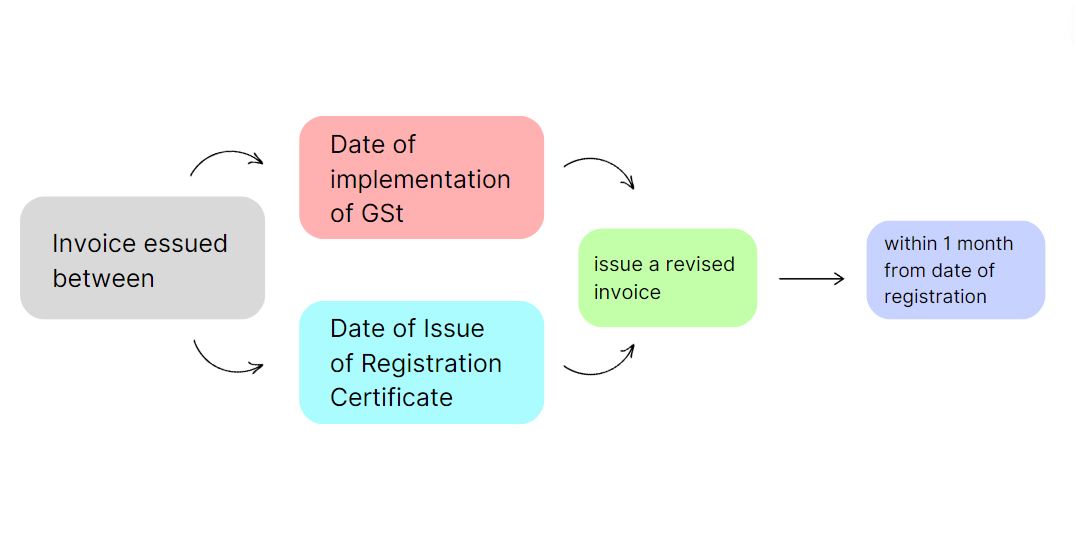

Below image explains the process of issuing a revised invoice:

This applies to all the invoices issued between the date of implementation of GST and the date your registration certificate has been issued.

As a dealer, you must issue a revised invoice against the invoices already issued. The revised invoice has to be issued within 1 month from the date of issue of the registration certificate.

Frequently Ask Question

Invoice date refers to the date when the invoice is created on the bill-book, while the due date is when the payment is due on the invoice.

In case of GST payable under reverse charge, you must additionally mention that tax is paid on a reverse charge, on the GST invoice.

Yes, the invoice serial number must be maintained strictly. You may change the format by providing a written intimating the GST department officer along with reasons for the same.

Yes, you can digitally sign invoice through DSC.